SVCO

Limited Company vs Self-Employed: Which is More Tax Efficient in 2025?

you are starting or growing a business in the UK, choosing the right business structure is essential. One of the most common decisions new business owners face is whether to operate as a limited company or remain self-employed. This guide explores the limited company vs self-employed UK 2025 comparison, focusing on tax efficiency, legal protection, cost implications, and long-term benefits.

What is the Difference Between a Limited Company and Being Self-Employed?

Self-Employed (Sole Trader):

A self-employed person runs the business as an individual. You and your business are legally the same entity. You are responsible for all debts and liabilities, and your income is taxed through the Self Assessment system.

Limited Company:

A limited company is a separate legal entity. It is responsible for its own debts, pays Corporation Tax on profits, and allows owners (shareholders) and directors to extract income through salary and dividends.

This distinction is key when comparing limited company vs self-employed UK 2025 from a tax and risk perspective.

Tax Comparison: Limited Company vs Self-Employed UK 2025

| Business Type | Tax Type | Rate (2025) |

|---|---|---|

| Self-Employed | Income Tax | 20%, 40%, 45% |

| National Insurance (Class 2 & 4) | Up to 9% | |

| Limited Company | Corporation Tax | 19% to 25% (based on profits) |

| Income Tax on Salary | According to PAYE thresholds | |

| Dividend Tax | 8.75%, 33.75%, 39.35% |

By incorporating, many business owners benefit from lower Corporation Tax and more flexibility in how profits are distributed, making the limited company option more tax efficient beyond certain income thresholds.

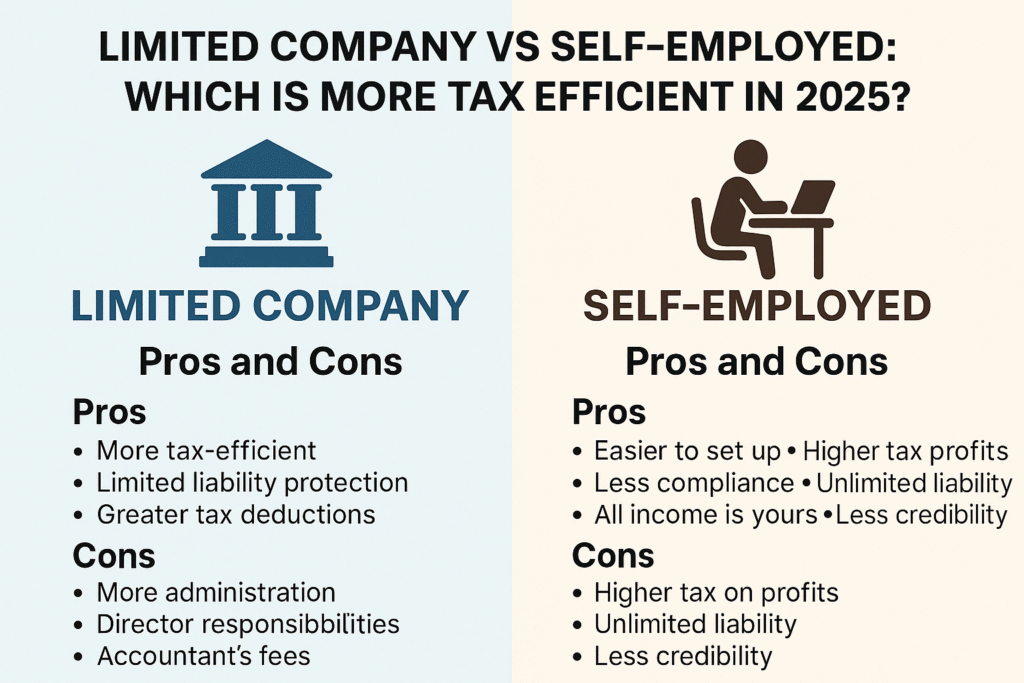

Pros and Cons of Being Self-Employed

Advantages:

- Simple and inexpensive to set up

- Less administrative burden

- Full control over business decisions and income

Disadvantages:

- Higher tax rates on growing profits

- Unlimited personal liability

- May lack credibility with lenders and suppliers

Pros and Cons of Operating as a Limited Company

Advantages:

- Tax-efficient profit extraction through dividends

- Limited liability protection for directors and shareholders

- More professional image for business clients

- Greater access to tax planning strategies and allowable expenses

- Possibility of income splitting with a spouse

Disadvantages:

- More complex accounting and filing responsibilities

- Increased costs for compliance and accountancy support

- Directors have legal obligations

When Should You Choose a Limited Company Over Being Self-Employed?

For many people, the switch from self-employed to limited company becomes beneficial when:

- Annual profits exceed £30,000 to £40,000

- You want to build business credit and a professional image

- You plan to reinvest profits or grow your business

- You need personal liability protection

- You want to benefit from tax planning and pension contributions

These factors make the limited company vs self-employed UK 2025 decision especially important for growing businesses.

Tax Saving Tips for Limited Companies in the UK

- Take a low director’s salary (within personal allowance)

- Draw additional income as dividends to save on National Insurance

- Claim all business expenses including home office, travel, and subscriptions

- Make pension contributions directly from the company

- Hire family members if they contribute to the business

- Retain profits within the company to defer personal tax

What About VAT?

If your annual taxable turnover exceeds £90,000, VAT registration is compulsory. Both self-employed individuals and limited companies can register voluntarily. Being VAT-registered may improve cash flow and increase business credibility, especially in B2B sectors.

Conclusion

There is no universal answer to the limited company vs self-employed UK 2025 question—it depends on your income level, business goals, and personal preferences. For smaller businesses, self-employment might offer simplicity and lower costs. However, as profits grow, the tax savings and legal protections offered by a limited company often outweigh the extra admin.

Before deciding, speak to a qualified accountant to ensure your chosen structure aligns with your business objectives and minimises your tax burden.